How I Built Passive Income Streams Without Risking Everything

What if your money could work while you sleep? I started with nothing but curiosity and a fear of living paycheck to paycheck. After testing multiple strategies—some failing hard—I discovered how real passive income works. It’s not about get-rich-quick schemes; it’s about smart positioning in the right markets. This is my journey, the lessons that hurt, and the moves that finally paid off—shared so you don’t repeat my mistakes. The truth is, building lasting income streams doesn’t require luck or a six-figure starting point. It demands clarity, patience, and a willingness to learn from missteps. What follows is a roadmap grounded in real experience, not theory—designed to help you grow financial confidence without gambling your security.

The Wake-Up Call: Why I Needed Financial Freedom

For years, I believed that working hard meant I was doing enough. I held a stable job, paid my bills on time, and even managed to save a little each month. But despite that, I never felt secure. Every raise was quickly absorbed by rising expenses—groceries, utilities, insurance, and the quiet creep of inflation. The more I earned, the more I spent, and the cycle never slowed. Then came the year my car broke down just weeks after an unexpected medical bill. That moment exposed how fragile my finances really were. I wasn’t saving for the future; I was surviving the present.

It was during that period of stress that I first heard the term "passive income." At first, it sounded like marketing fluff—something promised by online gurus selling dreamy lifestyles. But the more I looked into it, the more I realized there was substance behind the idea. Real people were earning money from sources that didn’t demand their constant time. That sparked a quiet revolution in my thinking: what if I could create systems that generated returns even when I wasn’t actively working? The idea wasn’t about quitting my job overnight. It was about building a parallel path—one that offered breathing room, options, and ultimately, freedom.

The turning point came when I calculated how long I’d need to work to retire at my current pace. The number was sobering. Even with retirement contributions, I was decades behind where I needed to be. That’s when I committed to learning. Not just about saving, but about making money work for me. I began reading financial reports, listening to investor interviews, and studying how wealth compounds over time. I realized that time was both my greatest ally and my most wasted resource. The earlier I started, the more power compounding would have. And so, with modest savings and a lot of questions, I took my first cautious steps into the world of income-generating assets.

Passive Income Decoded: What It Really Means (And What It Doesn’t)

One of the biggest mistakes I made early on was confusing passive income with effortless income. I thought it meant setting something up once and then collecting checks forever. Reality proved otherwise. True passive income requires significant upfront effort—research, setup, and often, ongoing maintenance. The key difference is that once the system is in place, it doesn’t scale with your time. You’re not trading additional hours for additional dollars. That’s what sets it apart from side gigs like freelance work or part-time jobs, where income stops the moment you stop working.

There are several types of income streams that qualify as genuinely passive. Dividend-paying stocks, for example, distribute a portion of company profits to shareholders. Once you own the shares, the payments come regularly, often quarterly, with no further action required. Real estate rental income is another classic example, though it can lean toward semi-passive depending on management. If you handle repairs, tenant issues, or late-night calls, the workload increases. But with professional management or REITs (Real Estate Investment Trusts), the burden drops significantly. Then there are digital products—e-books, online courses, or stock photography—that can generate sales long after the initial creation effort.

What doesn’t count as passive? Anything that demands your continuous attention. Driving for ride-sharing apps, selling handmade goods on marketplaces, or managing social media accounts for clients—all of these are active income streams, no matter how flexible they seem. They may fit around your schedule, but they don’t grow independently. I learned this the hard way when I launched a small e-commerce store. It took months to build, and while it did generate sales, I had to constantly update listings, handle customer service, and manage inventory. The income wasn’t passive—it was just remote work.

Understanding this distinction helped me focus on opportunities where the effort didn’t scale with the reward. I began prioritizing assets that could run in the background—ones that required minimal intervention once established. This shift in mindset was crucial. It allowed me to stop chasing busywork and start building systems that could grow over time without consuming my life.

Market Analysis That Actually Helps: Finding Opportunities Where Others See Noise

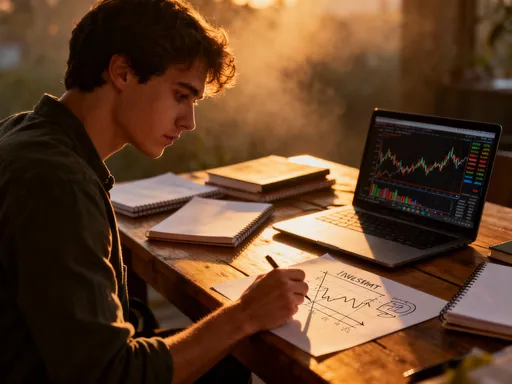

When I first started investing, I reacted to headlines. A news story about a booming sector would send me searching for stocks, often buying at peak prices. I chased trends without understanding fundamentals, and more than once, I bought high and sold low. It didn’t take long to realize that emotional decision-making was eroding my progress. I needed a better approach—one rooted in observation, not reaction. That’s when I began treating market analysis like a long-term study rather than a race to spot the next big thing.

I started by tracking broad economic indicators that anyone can access: interest rate trends, employment data, and consumer spending patterns. These don’t predict short-term movements, but they reveal underlying shifts in the economy. For example, when interest rates began rising after years of being near zero, I knew that savings accounts and certain bonds would become more attractive. At the same time, I noticed that overvalued growth stocks were correcting. This wasn’t about timing the market perfectly—it was about positioning myself in sectors with structural advantages.

One area I studied closely was renewable energy. It wasn’t a sudden fascination; it was a response to clear trends. Governments were increasing incentives, technology costs were falling, and consumer demand for sustainable solutions was rising. Instead of betting on a single company, I looked at the entire ecosystem—solar panel manufacturers, battery storage firms, and utility companies expanding clean energy capacity. I didn’t need to pick winners; I could gain exposure through low-cost index funds focused on the sector. This reduced my risk while still allowing me to benefit from long-term growth.

Digital services were another space I explored. The shift toward remote work and online learning created lasting demand for cloud-based tools, cybersecurity, and digital content. Rather than trying to predict which startup would dominate, I focused on established companies with strong cash flows and recurring revenue models. These businesses weren’t flashy, but they were resilient. Their income streams were predictable, and many paid dividends. By aligning my investments with macro trends—rather than hype cycles—I was able to make decisions with greater confidence and less anxiety.

Building Assets That Generate Value: My Approach to Smart Investment

Not all assets are created equal when it comes to generating passive income. Some appreciate in value but don’t produce cash flow. Others generate income but come with high maintenance costs. My goal was to find the sweet spot: assets that delivered consistent returns with minimal ongoing effort. I started by focusing on dividend-paying stocks, particularly those with a history of increasing payouts over time. These companies tended to be well-established, with strong balance sheets and stable earnings. The dividends provided a steady stream of income, which I could either reinvest or use to cover living expenses.

Real estate was another area I explored, but I approached it cautiously. I knew that owning rental property could be lucrative, but I also understood the risks—vacancies, repairs, difficult tenants. To reduce the workload, I considered REITs, which allow investors to own shares in large-scale properties like apartment complexes, shopping centers, or office buildings. These trusts are required by law to distribute at least 90% of their taxable income to shareholders, making them a reliable source of dividends. I allocated a portion of my portfolio to REITs focused on residential and industrial properties, which had shown resilience during economic downturns.

I also experimented with peer-to-peer lending platforms, where individuals lend money to borrowers in exchange for interest payments. While the returns were attractive, I limited my exposure due to the higher risk of default. I treated it as a satellite holding—a small part of the portfolio used to diversify income sources, not a core strategy. Similarly, I looked into high-yield savings accounts and certificates of deposit, especially during periods of rising interest rates. These weren’t glamorous, but they offered safety and predictable returns, which balanced out the more volatile parts of my portfolio.

Diversification was key. I didn’t put all my money into one type of asset. Instead, I spread it across different categories—equities, real estate, fixed income—each with its own risk and return profile. More importantly, I diversified by effort level. Some investments required occasional monitoring, while others needed almost no attention. This approach ensured that even if one income stream underperformed, others could compensate. Over time, this balance helped me build a portfolio that worked for me—not just financially, but in terms of time and peace of mind.

Risk Control: Protecting Gains Without Paralyzing Progress

I learned about risk the hard way. In my early days, I invested a significant portion of my savings in a single stock that had been heavily promoted online. It surged at first, feeding my confidence. Then, without warning, the company missed earnings, and the stock plunged. I held on, hoping it would recover, but it never did. That loss taught me a vital lesson: no return is worth risking your financial foundation. Since then, I’ve built risk management into every decision I make.

One of my core rules is position sizing. I never allocate more than a small percentage of my portfolio to any single investment. This limits the damage if something goes wrong. I also set clear exit triggers—predefined points at which I will sell, whether due to a drop in value, a change in fundamentals, or a better opportunity elsewhere. These rules remove emotion from the process. When a stock falls, I don’t panic. I check whether it’s within my risk tolerance and act according to plan.

Another layer of protection is stress-testing my income streams. I ask questions like: What happens if interest rates rise? What if a tenant moves out? What if a dividend is cut? By anticipating potential setbacks, I can prepare for them. For example, I maintain an emergency fund separate from my investment accounts. This means I don’t have to sell assets at a loss during a downturn to cover unexpected expenses. I also prioritize liquidity in part of my portfolio—keeping some assets that can be converted to cash quickly if needed.

Perhaps the most important principle I’ve adopted is that capital preservation comes before growth. I’d rather earn a modest return on a safe investment than chase high yields that could vanish overnight. This doesn’t mean I avoid risk entirely—no investment is risk-free. But I take calculated risks, informed by research and aligned with my long-term goals. Over time, this disciplined approach has allowed me to grow my wealth steadily, without the rollercoaster emotions that come from speculation.

Practical Steps: Turning Insight Into Action (Without Overcomplicating)

Knowledge is only valuable when it leads to action. I’ve seen too many people get stuck in the research phase, endlessly reading articles and watching videos without ever taking the first step. I was there once. The fear of making a mistake felt paralyzing. But I realized that perfection isn’t the goal—progress is. I started small, with an amount I could afford to lose, and focused on learning by doing.

My first move was opening a brokerage account with a low-cost provider that offered access to dividend-paying ETFs and fractional shares. This allowed me to begin investing with a modest sum. I set up automatic transfers from my checking account, so a fixed amount was invested each month regardless of market conditions. This strategy, known as dollar-cost averaging, reduced the risk of buying at a peak and instilled discipline in my routine.

I also created a simple tracking system. Every quarter, I reviewed my portfolio’s performance, dividend income, and allocation. I didn’t obsess over daily fluctuations. Instead, I looked for trends—was my income growing? Was my diversification still balanced? If needed, I made small adjustments, like rebalancing or redirecting reinvestments. I used basic spreadsheet tools and free financial apps to stay organized, avoiding overly complex software that could become a distraction.

Reinvestment was another key habit. In the beginning, I directed all dividends back into the portfolio to accelerate growth. Only when the passive income reached a meaningful level did I start using a portion for personal expenses. This delayed gratification paid off. By letting compounding work over time, my portfolio grew faster than it would have if I had spent the early returns. The process wasn’t complicated, but it required consistency. I treated it like a monthly bill—non-negotiable and automatic.

Long-Term Mindset: Why Patience Outperforms Hustle

The final shift in my journey wasn’t about money—it was about mindset. Early on, I wanted quick results. I measured success by monthly gains and got discouraged when progress felt slow. But over time, I began to see the power of consistency. Small, regular contributions, combined with reinvested dividends and steady appreciation, created momentum. What felt insignificant at first—a few hundred dollars in dividends—grew into thousands over years. The real breakthrough wasn’t a single investment win; it was the cumulative effect of disciplined habits.

I also developed emotional resilience. Markets fluctuate. Some years are strong; others are flat or negative. Instead of reacting, I learned to stay the course. I reminded myself that my goal wasn’t to beat the market every year, but to build lasting financial independence. This long-term view helped me avoid panic selling during downturns and overconfidence during booms. I stopped comparing myself to others who claimed overnight success. Their stories were often incomplete or exaggerated. My path was quieter, but it was mine—and it was sustainable.

Today, my passive income covers a significant portion of my living expenses. I still work, but not out of necessity. I have choices. That freedom didn’t come from a single brilliant move. It came from years of small, smart decisions—avoiding reckless risks, reinvesting wisely, and staying focused on the long game. The most valuable lesson I’ve learned is that financial security isn’t about how much you earn, but how well you manage what you have. Anyone can build passive income, not through luck or genius, but through clarity, patience, and unwavering discipline. The journey starts not with a windfall, but with a decision—to begin, and to keep going.