How I Designed My Investment Layout for Early Retirement — A Beginner’s Real Talk

What if you could retire years earlier than everyone else without winning the lottery or landing a six-figure job? I asked myself the same question when I started my journey toward financial freedom. As a total newbie, I felt overwhelmed — where do you even begin? This is the honest story of how I built a simple but effective investment layout that actually works, what mistakes I made, and the practical steps that changed everything. It wasn’t about getting rich quick. It was about making consistent, informed choices that added up over time. And today, with a clear strategy in place, early retirement isn’t a fantasy — it’s a realistic goal within reach.

The Wake-Up Call: Why Early Retirement Isn’t Just a Dream

For most of my adult life, I assumed retirement would come at 65, maybe later if Social Security changed or my employer cut benefits. I imagined working until I was physically unable to, then finally slowing down with a modest pension and whatever I’d managed to save. But that vision started to feel less like a plan and more like a gamble — a bet that my health, job stability, and the economy would all align decades from now. That uncertainty became unbearable. Then, I read about financial independence and early retirement, not as luxuries for tech entrepreneurs, but as achievable goals for ordinary people who plan carefully.

The truth is, saving alone won’t get you there. If you’re putting money into a regular savings account earning 0.5% interest, inflation will quietly erode your purchasing power. Over 20 years, even $500,000 saved could lose nearly a third of its real value. That’s not security — that’s deferred stress. Investment, on the other hand, offers the potential to grow wealth at a rate that outpaces inflation. When done wisely, it turns time into an ally. I realized that the key wasn’t earning more — though that helps — but using what I already had more effectively. The goal shifted from merely surviving in retirement to designing a life with freedom and choice.

Like many people, I started with a tight budget, student debt, and no financial mentorship. I wasn’t earning six figures, and I didn’t inherit wealth. But I did have time — and that, I learned, is the most powerful asset a young investor can possess. The earlier you begin, the more compound growth can work in your favor. Even small, regular contributions can grow into significant sums when given decades to compound. This realization was my wake-up call: early retirement wasn’t about luck or privilege. It was about strategy, consistency, and understanding how money works. I decided to stop waiting and start learning.

Starting from Zero: My First Steps as a Clueless Beginner

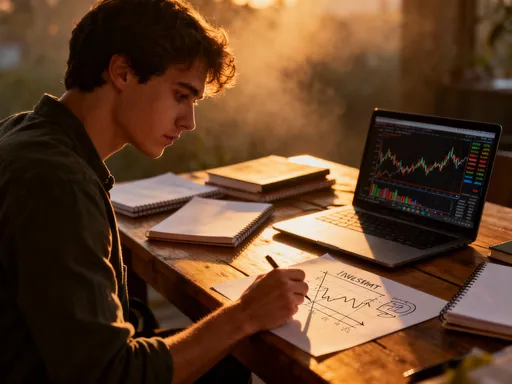

I remember opening my first brokerage account with a mix of excitement and dread. I clicked through the screens, selected a basic mutual fund because it had a high five-year return, and felt proud of myself — until I realized I had no idea what a mutual fund actually was. Was it safer than a stock? Did it pay dividends? How often should I check it? The terminology alone was overwhelming: asset allocation, expense ratios, tax lots, rebalancing. I spent hours reading articles that used phrases like “alpha generation” and “beta exposure,” none of which helped me understand what to do with my $200 monthly contribution.

My early attempts were messy. I bought individual stocks based on articles I read online, chasing companies that seemed trendy. I remember putting $1,000 into a tech stock because a friend said it was “going to the moon.” It dropped 30% in two months, and I sold in panic, locking in the loss. That hurt — not just financially, but emotionally. I felt foolish. I started to wonder if investing was only for people with MBAs or trust funds. But then I came across a simple idea: you don’t need to be an expert to get started. You just need to start.

So I shifted my mindset. Instead of trying to pick winners, I focused on building habits. I set up automatic transfers to my investment account every payday. I committed to learning one new concept each week — first, what a bond is; then, how index funds work; later, the difference between taxable and tax-advantaged accounts. I stopped watching financial news that made me anxious and started following a few plain-language blogs that emphasized long-term thinking. Slowly, the confusion lifted. I realized that investing isn’t about brilliance — it’s about behavior. The biggest hurdle wasn’t knowledge. It was fear. And the way through fear was action, even if that action was small and imperfect.

Building the Foundation: What an Investment Layout Really Means

One of the most important lessons I learned was that investing isn’t about picking stocks. It’s about designing a system — an investment layout — that works for your goals, risk tolerance, and timeline. Think of it like building a house. You wouldn’t start hammering nails without a blueprint. Yet so many people jump into investing without any plan at all. They react to market news, follow tips from social media, or chase whatever performed well last year. That’s not investing. That’s gambling.

An investment layout is your financial blueprint. It defines how your money is divided across different types of assets — each with a specific role. Some assets are meant to grow in value over time, like stocks. Others are designed to reduce risk and provide stability, like bonds. Some generate regular income, like dividend-paying funds. And some are kept in cash or cash equivalents for emergencies and short-term needs. The arrangement of these pieces — their proportions and interactions — matters far more than any single investment choice. A well-structured layout can survive market downturns, keep you on track during volatile periods, and steadily move you toward your goals.

For me, the foundation started with three core principles: diversification, simplicity, and cost control. Diversification means spreading your money across different asset classes so that a loss in one area doesn’t destroy your entire portfolio. Simplicity means avoiding complex products you don’t understand. And cost control means paying attention to fees, because even small differences can have a massive impact over time. I chose low-cost index funds as the backbone of my portfolio because they automatically provide broad diversification — owning hundreds or even thousands of companies with one purchase. This eliminated the need to pick individual winners and reduced my risk significantly.

My layout wasn’t perfect at first. I adjusted it as I learned more. But having a structure gave me confidence. When the market dropped, I didn’t panic. I knew my layout was designed for long-term growth, not short-term fluctuations. I wasn’t betting on any single company’s success. I was betting on the overall economy to grow over time — a much safer and more reliable bet. That shift in perspective changed everything.

Mapping Out My Strategy: Balancing Growth and Safety

Designing my investment strategy wasn’t about finding the highest return possible. It was about finding the right balance between growth and safety for my situation. I started by asking myself three questions: How much risk can I afford to take? How much risk am I comfortable taking? And how long will I need this money to last? The answers shaped my asset allocation — the percentage of my portfolio in stocks, bonds, and cash.

Because I was in my thirties and retirement was decades away, I could afford to take more risk in pursuit of higher long-term returns. So I began with an 80/20 split — 80% in stock index funds and 20% in bond index funds. This gave me strong growth potential while still providing some stability. Over time, I made small adjustments based on life changes. When I bought a house, I temporarily increased my cash reserve to cover the down payment and closing costs. When I had a child, I reviewed my emergency fund and made sure it could cover at least a year of expenses if needed. These weren’t emotional reactions — they were planned updates to my layout.

One of the biggest mistakes beginners make is trying to time the market. I almost made this error myself. In 2020, when the market crashed due to the pandemic, I felt the urge to pull everything out and wait for “calmer times.” But I remembered my layout was designed for exactly this kind of event. Historically, markets recover and continue upward over the long term. Selling during a downturn locks in losses and means you miss the recovery. Instead, I did the opposite — I kept contributing and even bought more shares at lower prices. That decision, rooted in discipline rather than emotion, paid off handsomely over the next two years.

Another key part of my strategy was rebalancing — periodically adjusting my portfolio back to its original allocation. If stocks performed well and grew to 85% of my portfolio, I would sell a little and buy bonds to bring it back to 80/20. This forces you to “sell high and buy low,” which is the opposite of what most people do. Rebalancing keeps your risk level consistent and prevents any single asset class from dominating your portfolio. I set a schedule to review my allocation once a year, which made the process simple and automatic.

Avoiding Cost Traps: How Fees and Taxes Quietly Eat Returns

One of the most eye-opening discoveries in my journey was how much fees and taxes can erode investment returns — not dramatically, but quietly, over decades. I once compared two mutual funds that tracked the same market index. One had an expense ratio of 0.03%, the other 1.0%. At first glance, the difference seemed small. But when I ran the numbers, I saw that over 30 years, the higher-fee fund could cost me tens of thousands of dollars in lost returns — even if both funds performed identically. That’s money I’d never see, simply for paying more to do the same thing.

Expense ratios aren’t the only cost. There are also trading fees, advisory fees, and hidden costs in complex financial products. I learned to avoid actively managed funds that charge high fees in exchange for “beating the market” — a promise most fail to deliver. Instead, I focused on low-cost index funds and exchange-traded funds (ETFs) that simply aim to match market returns. These are not flashy, but they are effective. By minimizing fees, I kept more of my returns and let compounding work harder for me.

Taxes are another silent wealth killer. I used to buy and sell investments in my regular brokerage account without thinking about capital gains. Then I realized I was paying taxes on every profitable trade — sometimes pushing me into a higher tax bracket. That’s when I shifted my strategy to prioritize tax efficiency. I placed high-growth investments, which are more likely to generate capital gains, inside tax-advantaged accounts like my 401(k) and IRA. These accounts allow investments to grow without being taxed annually. I used my taxable brokerage account for investments that generate qualified dividends or are tax-efficient ETFs.

I also took advantage of tax-loss harvesting — selling investments at a loss to offset gains elsewhere in my portfolio. This isn’t about chasing losses, but about using the tax code wisely. Over time, these small optimizations added up. I didn’t get rich from them, but I avoided getting poorer from avoidable costs. The lesson was clear: in investing, what you keep matters more than what you earn on paper.

Staying the Course: Discipline, Patience, and Small Wins

If I had to pick one factor that made the biggest difference in my journey, it wouldn’t be a clever strategy or a lucky investment. It would be consistency. The market doesn’t reward timing. It rewards time. And staying invested — through bull markets and bear markets, through personal doubts and global crises — is the hardest but most important part of the process.

There were times I wanted to quit. In 2022, when inflation spiked and the stock market dropped sharply, I read headlines predicting a long recession. Friends joked about moving to a cabin in the woods and giving up on investing. I felt the same urge. But I reminded myself that my layout wasn’t built for perfection. It was built for resilience. I kept making my monthly contributions. I didn’t panic-sell. And within a year, the market had recovered much of its losses. Those moments of doubt didn’t disappear, but my habits kept me on track.

Automation was a game-changer. Setting up automatic contributions meant I didn’t have to decide every month whether to invest. The money moved before I could talk myself out of it. I also stopped checking my account daily. Instead, I reviewed it quarterly — enough to stay informed, not enough to react emotionally. I celebrated small wins: the first time my portfolio earned more in a month than I did from my side gig, the first dividend check that could cover a grocery run, the day my retirement savings passed $100,000. These milestones weren’t life-changing on their own, but they reinforced that progress was happening, even when it felt slow.

Patience became a skill I had to practice. I stopped comparing my journey to others — the cousin who made money in crypto, the coworker who sold a startup. Everyone’s path is different. My focus stayed on the process, not the outcome. I wasn’t trying to get rich. I was trying to be consistent. And over time, consistency became compounding. The money I invested at 30 had decades to grow. The habits I built in my thirties became automatic in my forties. The layout I designed didn’t guarantee success, but it greatly improved my odds.

Looking Ahead: Freedom Within Reach, One Decision at a Time

Today, early retirement isn’t just a dream. It’s a goal with a clear path. I still have years to go, but the trajectory is real. My investment layout continues to evolve — a little more conservative as I age, more focused on income generation as I get closer to retirement. But the core principles remain the same: diversification, low costs, tax efficiency, and emotional discipline.

Financial freedom isn’t about quitting work forever or living on a beach. For me, it’s about having choices. It’s about being able to say no to jobs that drain me, to spend more time with family, to pursue meaningful projects without worrying about income. It’s about peace of mind — knowing that I’ve built a foundation that can support the life I want.

This journey taught me that you don’t need to be a genius or a millionaire to build wealth. You need a plan, the willingness to learn, and the courage to stay the course. Every dollar invested, every fee avoided, every moment of patience adds up. The power of compounding doesn’t care how much you start with — it only cares that you start.

If you’re reading this and feeling overwhelmed, remember: I was there too. You don’t have to know everything today. You just have to take one step. Open an account. Set up a small automatic transfer. Read one article about index funds. Each decision builds momentum. And over time, those small decisions can lead to a future of freedom — not by accident, but by design.