How I Survived My Debt Crisis — Real Financial Skills That Actually Work

I once opened my bank app and felt my stomach drop. Bills stacked up, interest crept higher, and I had no clue how to stop the bleed. Sound familiar? I’m not a finance expert — just someone who made every mistake and finally learned how to fight back. This isn’t about quick fixes or magic formulas. It’s about real financial skills I tested, failed at, and eventually mastered. If you’re drowning in debt, this is where recovery starts — one smart, painful, honest step at a time.

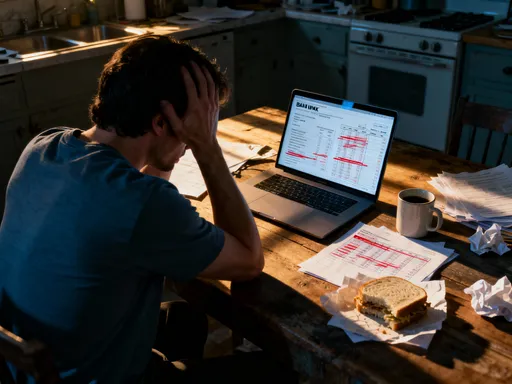

Hitting Rock Bottom: The Moment I Realized I Was in a Debt Crisis

It wasn’t one catastrophic event that brought me to my knees — it was a slow erosion, like water wearing down stone. For years, I told myself I was managing. I paid the minimums, avoided looking at statements, and justified every purchase with, “I’ll catch up next month.” But next month never came. The turning point came on a quiet Tuesday morning. I was making coffee, half-awake, and opened my banking app out of habit. That’s when I saw it: my credit card balance had crossed $18,000. My car loan was barely dented after three years. My student loan interest had overtaken the principal. And worst of all, I had less than $200 in savings. My hands shook. I sat on the kitchen floor, mug forgotten, and cried. This wasn’t just stress — it was a full-blown financial crisis.

Looking back, the warning signs had been there for years. I was juggling due dates, moving money between cards to cover essentials. I ignored calls from collection agencies, pretending they weren’t mine. Sleep became elusive. I’d wake up at 3 a.m., heart racing, mentally replaying bills I couldn’t pay. My relationships suffered. I avoided social events because I couldn’t afford to split the check. I felt isolated, ashamed, like I was the only one failing while everyone else had it together. But I wasn’t alone. Millions of people — especially women in their 30s and 40s managing households, childcare, and aging parents — face this silent struggle. The shame keeps us quiet, but the truth is, debt doesn’t discriminate. It creeps in through medical bills, job loss, divorce, or simply years of living paycheck to paycheck. Recognizing that I wasn’t broken — just overwhelmed — was the first step toward healing.

What finally broke through the denial was not a lecture or a spreadsheet, but a conversation. I confided in a friend, not expecting much. To my surprise, she said, “I’ve been there.” She didn’t offer solutions, just empathy. That moment of connection lifted a weight I hadn’t realized I was carrying. It made me see that financial crisis isn’t a moral failure — it’s a solvable problem. And like any problem, it starts with acknowledgment. I had to admit, out loud, “I am in debt, and I need a plan.” That confession didn’t fix anything, but it ended the isolation. It allowed me to stop hiding and start acting. For you, that moment might come while reviewing a credit report, receiving a late notice, or simply feeling that constant knot in your stomach. When it comes, don’t look away. That discomfort is not your enemy — it’s your signal. Your journey back to control begins the second you stop pretending.

Facing the Numbers: How I Took Full Ownership of My Debt

Once I admitted I was in trouble, the next step was terrifying: facing the full scope of what I owed. I’d spent years avoiding my statements, deleting emails from creditors, and hoping things would magically improve. But real progress starts with truth. I cleared my kitchen table, gathered every bill, credit card statement, and loan document I could find. I printed them, sorted them by type, and began listing each debt with its balance, interest rate, minimum payment, and due date. No filters. No excuses. Just facts.

This process wasn’t about inducing panic — it was about gaining clarity. I discovered I had seven separate debts: two credit cards, a personal loan, a medical bill in collections, my car loan, student loans, and a small payday loan I’d taken out during a cash crunch. The total? $38,742. Seeing that number written down was painful, but also strangely liberating. For the first time, I wasn’t guessing or fearing the unknown — I knew exactly what I was dealing with. Knowledge, I realized, is power. Ignorance might feel safer in the short term, but it keeps you stuck. Facing the numbers stripped away the fog of anxiety and replaced it with a roadmap.

I learned that ownership doesn’t mean shame. It means responsibility without self-judgment. I didn’t berate myself for past choices. Instead, I asked, “What can I control now?” I took a photo of the full debt list and taped it to my bathroom mirror. Every morning, I saw it. Not as a punishment, but as a reminder of my commitment. I also checked my credit report through a free, official service to ensure I hadn’t missed anything. It’s common for old debts to resurface or for errors to exist. Finding one incorrect charge gave me a small win — disputing it boosted my confidence. The goal wasn’t perfection; it was accuracy. When you know what you owe, you stop reacting and start planning. This step isn’t glamorous, but it’s foundational. You can’t fix what you won’t face. And once you do, you’re no longer a victim of your finances — you’re the one in charge.

The Debt Map: Creating a Clear Path Out of the Chaos

With all my debts listed, the next challenge was making sense of the chaos. I needed a visual tool — something that would show me not just how much I owed, but how to get out. I called it my Debt Map. It was simple: a large sheet of paper divided into columns — creditor name, balance, interest rate, minimum payment, and payoff timeline. I used colored markers to highlight high-interest debts in red and long-term loans in blue. I drew arrows showing which debts I’d tackle first and how extra payments would shorten timelines.

The Debt Map wasn’t just data — it was a strategy in motion. I plotted each debt on a timeline, estimating how long it would take to pay off at minimum payments versus with increased contributions. The results were shocking. One credit card with a $5,200 balance and 24.9% APR would take over 14 years to pay off if I only made minimums — and I’d pay nearly $5,000 in interest alone. That visual hit me harder than any number. It showed me that doing nothing was costing me years of freedom and thousands of dollars. The map also revealed hidden drains: small balances with sky-high interest, recurring fees, and loans with prepayment penalties. I hadn’t realized how much these invisible costs were slowing my progress.

Creating the map forced me to think critically about priorities. Was the smallest balance the best to pay off first? Or the highest interest? What about due dates and cash flow? The map helped me see patterns — like how three of my debts had due dates in the first week of the month, straining my budget. I contacted lenders to adjust due dates, spreading them out more evenly. I also identified which debts were affecting my credit score the most and which could be settled for less. The map evolved over time — I updated it monthly, celebrating when a red block shrank or a line was crossed out. It became more than a tool; it was proof of progress. For anyone overwhelmed by debt, I recommend starting here. Don’t rush to pay anything off yet. First, see the whole picture. A clear map doesn’t eliminate the mountain, but it shows you the path up.

Choosing My Strategy: Why I Picked What Worked for Me (Not the Hype)

Now came the big question: how to actually pay it down? I’d heard of the debt snowball method — paying off the smallest balances first for quick wins — and the debt avalanche — tackling the highest interest rates to save money. Experts argued fiercely about which was better. But I realized the real question wasn’t which strategy was theoretically optimal — it was which one I could stick with. Because no plan works if you quit.

I studied both approaches. The avalanche would save me the most in interest — nearly $3,000 over five years, according to my calculations. But it meant attacking my $12,000 student loan first, which felt overwhelming. The snowball offered faster emotional wins. My medical bill was only $1,100. Paying that off in two months would give me momentum. I tested both mentally. Could I stay motivated if my largest debts barely budged for months? Probably not. I needed to see progress to believe it was possible. So I chose a hybrid approach: I used the snowball method for my first three debts — the ones under $2,000 — to build confidence, then switched to the avalanche for the larger, high-interest ones.

This decision wasn’t about perfection — it was about sustainability. I automated minimum payments to avoid late fees, then allocated every extra dollar to the target debt. When the medical bill was paid, I celebrated — not with a splurge, but with a quiet moment of pride. I took a photo of the zero balance and saved it. Then I rolled that payment into the next smallest debt. The momentum built. Each payoff freed up more money and strengthened my resolve. I didn’t care what the finance gurus said. My strategy wasn’t textbook, but it was mine. And it worked. The key lesson? There is no single “right” way. The best method is the one that aligns with your psychology, cash flow, and lifestyle. If you’re motivated by quick wins, start small. If you’re driven by logic, attack the highest interest. But whatever you choose, commit. Consistency beats theory every time.

Cutting the Burn: How I Reduced My Monthly Outflow Without Losing My Mind

Paying down debt required more than just a plan — it required cash flow. I had to free up money without sacrificing my family’s well-being or my sanity. I wasn’t willing to live on rice and beans or give up every joy in life. Instead, I looked for smart, sustainable cuts — the kind that add up over time without feeling like punishment.

I started with fixed expenses, the ones that felt “set in stone.” My car insurance was up for renewal. I shopped around and switched providers, saving $48 a month. My internet bill had doubled over three years due to promotional rates expiring. I called customer retention, threatened to switch, and got a $30 monthly discount. I renegotiated my cell phone plan, bundling lines and removing unused features, cutting $22 from the bill. These weren’t heroic moves — just routine checks I’d neglected for years. Together, they freed up over $100 a month. I applied every dollar to my debt.

Next, I examined subscriptions. I counted eight — streaming services, a meal kit, a fitness app I hadn’t opened in months, a cloud storage plan, and more. I canceled four I didn’t use regularly, saving $67 monthly. I rotated streaming services instead of keeping all at once. For groceries, I stopped shopping while tired or hungry, which had led to impulse buys. I planned meals weekly, used a list, and stuck to it. I bought generic brands, used coupons, and shopped later in the day for markdowns. These changes saved me about $150 a month — and surprisingly, I ate better. I also paused non-essential spending: no new clothes, no dining out, no home decor. I didn’t cut joy — I redirected it. I hosted potlucks instead of eating out, borrowed books from the library, and found free community events.

Not every attempt worked. I tried a strict zero-spend weekend that left me irritable and resentful. I learned that deprivation backfires. Sustainable change means balance. I allowed myself a small “fun fund” — $25 a month — for coffee, a magazine, or a movie rental. That tiny allowance prevented binge spending. The goal wasn’t to suffer — it was to redirect resources. Over a year, these adjustments freed up nearly $400 a month. That’s $4,800 redirected from consumption to freedom. Cutting the burn wasn’t about loss — it was about reallocation. And every dollar saved was a step closer to peace.

Building the Safety Net: Why I Started Saving Even While in Debt

Here’s a truth most debt advice gets wrong: I started saving before I was debt-free. It sounds counterintuitive. “Pay off debt first,” they say. But I’d learned the hard way that without a buffer, any surprise — a flat tire, a vet bill, a broken appliance — would throw me back into borrowing. I needed a safety net, no matter how small.

I began with $20 a month — less than the cost of a dinner out. I opened a separate savings account online, one without a debit card, making it harder to dip into. I set up automatic transfers the day after payday, so I never saw the money. At first, it felt pointless. $20 wouldn’t cover a real emergency. But I kept going. After six months, I had $120. Then $200. When my washing machine died, I used $180 from that account to cover the repair. I didn’t panic. I didn’t put it on a card. I fixed the problem and replenished the fund over the next two months. That moment changed everything. I had proven I could handle a crisis without debt.

Experts often recommend a full emergency fund of three to six months’ expenses, but that can feel impossible when you’re already stretched. I call my approach the micro emergency fund — $500 to $1,000 — enough to cover most small to mid-sized surprises. Building it while in debt taught me discipline and reduced anxiety. Knowing I had even a small cushion gave me mental space to focus on long-term goals. I wasn’t living in constant fear of the next shoe to drop. The psychological benefit was as valuable as the financial one. I stopped seeing saving and debt repayment as opposites. They were partners. Every dollar saved was a dollar of resilience. And resilience is what keeps you on track when life inevitably throws curveballs.

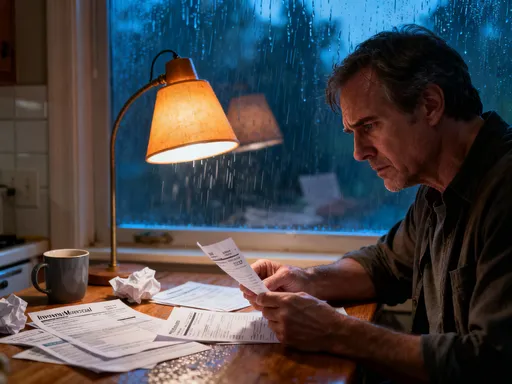

Staying on Track: Tools and Mindset Shifts That Kept Me Going

Debt repayment isn’t a sprint — it’s a marathon with hills, detours, and bad weather. There were months I slipped — a family emergency, a job slowdown — and my progress stalled. I felt frustrated, like I was back to square one. But I didn’t quit. What kept me going wasn’t willpower alone — it was systems and mindset.

I relied on tools. I used a free budgeting app to track every dollar, categorizing spending and setting monthly limits. I set up automatic payments for all debts, ensuring I never missed a due date. I added calendar reminders for bill reviews and fund transfers. I shared my goal with one trusted person — my sister — who checked in monthly. Accountability made a difference. Knowing someone else knew my target kept me honest. I also celebrated milestones: a paid-off card, $1,000 saved, six months without new debt. I marked them with small, non-financial rewards — a long bath, a walk in the park, a handwritten note to myself.

But the biggest shift was internal. I stopped measuring success by perfection and started valuing persistence. A missed payment wasn’t a failure — it was feedback. I learned to adjust, not give up. I replaced shame with curiosity: “Why did I overspend last month? What can I change?” I practiced self-compassion. This journey wasn’t about being perfect — it was about being consistent. I also reframed my relationship with money. It wasn’t the enemy. It was a tool — neutral, powerful, and within my control. Every decision, no matter how small, was a vote for the life I wanted. Over time, the anxiety faded. The constant mental load lightened. I wasn’t just paying off debt — I was rebuilding trust in myself.

From Crisis to Control — How Financial Skills Changed Everything

Today, I’m not rich. But I’m free. The $38,742 is gone. My credit cards are paid in full. I have a fully funded emergency account. I save regularly. I still budget, still track, still plan. Because financial health isn’t a destination — it’s a practice. What changed wasn’t my income, but my skills. I learned to face reality, make honest choices, and build systems that work. These aren’t secrets — they’re tools anyone can use.

This journey wasn’t about luck or a windfall. It was about daily decisions — saying no, adjusting habits, staying focused. It was hard. There were tears, setbacks, and days I wanted to quit. But it was worth it. More than the money, I gained confidence. I no longer feel powerless. I know I can handle whatever comes. For any woman reading this, struggling in silence, know this: you are not alone. You are not weak. You are capable of change. Start where you are. Use what you have. Do what you can. The first step is the hardest — but it’s also the most important. Face the numbers. Make a plan. Take one action. Then another. Financial freedom isn’t reserved for the wealthy. It’s built by ordinary people, one honest decision at a time. And you are already stronger than you think.