Why Smart Hiring Starts with Smarter Money Moves

What if the key to hiring the right people isn’t just about resumes—but your wallet? I learned this the hard way. After burning through cash on rushed hires, I discovered that asset allocation isn’t just for investments—it’s a game-changer for recruitment. When you align your financial strategy with talent decisions, everything shifts. This is how I turned hiring from a cost center into a growth engine—by treating people like the most valuable assets they really are. The truth is, every new hire represents not just a role to fill, but a capital decision with long-term implications. Mismanage it, and you drain resources, stall momentum, and weaken your foundation. Manage it wisely, and you unlock performance, innovation, and sustainable returns. This is the mindset shift every financially conscious leader must make: people are not expenses—they are appreciating assets, and how you fund them matters deeply.

The Hidden Cost of Bad Hiring (And Why It’s a Financial Crisis, Not Just HR Noise)

Many leaders view poor hiring as an HR problem—a misstep in screening or cultural fit. But beneath the surface, bad hiring is first and foremost a financial crisis. Consider the numbers: according to widely cited studies, the cost of a bad hire can range from 30% of the individual’s annual salary for entry-level roles to over 200% for executive positions when factoring in training, lost productivity, management time, and eventual severance. For a mid-level manager earning $80,000, that could mean a $160,000 financial hit. These are not abstract figures—they are real dollars diverted from product development, marketing, or customer acquisition.

Beyond direct costs, poor hires create ripple effects across the organization. A single underperforming employee can slow team output, erode morale, and increase turnover among high performers who grow frustrated with uneven contributions. In fast-moving environments, such delays translate into missed market opportunities, delayed launches, or weakened competitive positioning. The longer a mismatched hire remains, the greater the compound cost—not just in salary, but in lost momentum and strategic agility. This is especially critical for small and mid-sized businesses where every team member has an outsized impact on outcomes.

Moreover, the decision to hire is often treated as purely operational: “We need someone to do X.” But in reality, every open role represents a capital allocation decision. The funds used to pay salaries, benefits, and onboarding are not infinite. They compete with other investments—equipment, technology, inventory, or R&D. When leaders fail to evaluate hiring through a financial lens, they risk misallocating scarce resources. The question shouldn’t be “Can we afford to hire?” but rather “Can we afford not to hire the right person at the right time with the right budget?” Treating hiring as a financial lever—not just a staffing checkbox—forces discipline, prioritization, and strategic clarity.

Asset Allocation Isn’t Just for Stocks—It Applies to Your Team, Too

In personal finance, asset allocation refers to distributing investments across different categories—stocks, bonds, real estate—to balance risk and return. The same principle applies to talent. Employees are not line items on a P&L; they are income-generating assets whose contributions compound over time. A software engineer builds products that generate revenue. A sales professional closes deals that fund growth. A customer support specialist retains clients and protects margins. Each role, when properly resourced and aligned, produces measurable financial returns.

Just as over-concentrating a portfolio in one sector increases risk, over-investing in one type of talent can destabilize an organization. Imagine a startup that hires only senior developers but lacks marketing or customer success talent. Despite technical excellence, the company may struggle to acquire users or retain them—limiting revenue and stalling growth. Conversely, a business that prioritizes sales without investing in delivery capacity risks overpromising and underdelivering, damaging reputation and long-term value.

Smart talent allocation means building a balanced team across functions, experience levels, and innovation capacity. It involves strategic decisions: when to hire a generalist versus a specialist, when to invest in high-potential junior talent versus proven leaders, and how to structure roles to maximize return on investment. For example, allocating budget to train an internal candidate may yield higher long-term loyalty and cultural alignment than hiring externally at a premium. Similarly, investing in a high-impact role—like a product manager who can accelerate time-to-market—can generate disproportionate returns relative to cost.

This mindset shift—from seeing payroll as an expense to viewing talent as a growth asset—transforms how leaders approach hiring. It encourages proactive planning, disciplined budgeting, and performance tracking. Instead of reacting to immediate gaps, leaders begin to forecast talent needs based on strategic goals, much like projecting capital needs for expansion. When teams are treated as part of the balance sheet, not just the org chart, every hiring decision becomes a financial strategy in motion.

From Burn Rate to Growth Rate: How Financial Discipline Shapes Hiring Timing

One of the most common financial missteps in hiring is poor timing. Many organizations hire too early, driven by ambition or pressure, only to face cash crunches later. Others wait too long, missing growth windows because they lacked the team to execute. The key to avoiding both extremes lies in understanding financial runway—the number of months a business can operate based on its current cash reserves and burn rate. This metric should directly inform hiring decisions, not gut feeling or competitive anxiety.

Consider a tech startup with $600,000 in the bank and a monthly burn rate of $50,000. That’s a 12-month runway. If the company hires three new employees at $10,000 per month in total compensation, the burn rate jumps to $80,000, reducing runway to just 7.5 months. That lost time could mean the difference between securing a follow-on funding round and facing a forced down round—or worse, closure. In this context, every hire must be evaluated not just for its immediate benefit but for its impact on financial sustainability.

Delaying a hire, when done strategically, is not a sign of weakness—it’s a sign of discipline. It preserves capital for higher-impact moments, such as scaling after product-market fit or entering a new market. Many successful companies maintain lean teams in early stages, using freelancers, automation, or cross-functional roles to stretch resources. They time full-time hires to coincide with revenue inflection points, ensuring that new salaries are supported by incoming cash flow rather than depleted reserves.

Financial discipline also means recognizing that hiring can be phased. Instead of filling an entire department at once, a company might start with a single leader, validate the function’s impact, then expand gradually. This approach reduces risk and allows for course correction. For example, a business launching a customer support team might begin with one experienced hire, measure response times and customer satisfaction, and only scale after proving the model works. By aligning hiring pace with financial readiness, leaders turn recruitment from a cost driver into a lever for controlled, sustainable growth.

Risk Control: Diversifying Talent Like You Diversify Investments

In investing, diversification reduces exposure to any single point of failure. The same principle applies to workforce design. Over-relying on one skill set, profile, or employment model increases organizational risk. For example, a company staffed entirely with full-time, specialized engineers may struggle to adapt if market demand shifts toward user experience or AI integration. Similarly, a business dependent on a single high-performing salesperson faces significant disruption if that individual leaves.

Smart risk control in hiring involves creating a resilient, adaptable team structure. This includes building hybrid roles that combine complementary skills—such as a marketing professional with analytics expertise or a developer with product sense. These individuals can pivot more easily as priorities change, reducing dependency on narrow specialists. Cross-training existing employees also serves as a hedge, ensuring continuity during transitions and spreading institutional knowledge across the organization.

Flexible employment models—contractors, part-time experts, or project-based consultants—act as financial and operational buffers. They allow companies to scale up or down without long-term commitments, much like holding cash or liquid assets in a portfolio. For instance, during a product launch, a business might bring on a temporary UX designer to meet demand, then release the contract once the phase is complete. This approach maintains agility while controlling fixed costs.

Diversification also applies to experience levels. A team composed only of senior hires may deliver strong results but at a high cost and with less innovation capacity. Conversely, a team of only junior employees may lack the experience to navigate complex challenges. A balanced mix—seniors to provide mentorship and stability, mid-level staff to execute, and juniors to bring fresh ideas—creates a sustainable talent pipeline. This structure not only manages risk but also supports long-term growth by nurturing internal promotion and reducing turnover. Just as a well-diversified portfolio withstands market volatility, a well-structured team can adapt to changing business conditions without collapsing under pressure.

The 3-Phase Framework: Aligning Hiring Stages with Financial Readiness

To bring financial discipline to hiring, leaders need a clear framework that matches talent decisions to business maturity. A one-size-fits-all approach fails because financial constraints and strategic needs evolve over time. The following three-phase model provides a practical guide: (1) Pre-funding lean mode, (2) Post-injection scaling phase, and (3) Maturity optimization. Each stage requires distinct hiring goals, budget allocations, and risk tolerances.

In the pre-funding lean mode, cash is extremely limited, and survival is the priority. Hiring should focus on versatility and cost efficiency. Founders often wear multiple hats, and early hires must do the same. The goal is to achieve product-market fit with minimal overhead. At this stage, smart moves include using equity to attract talent, leveraging freelancers for specialized tasks, and delaying full-time hires until revenue begins to flow. The financial objective is capital preservation—every dollar spent must directly contribute to validation or growth.

Once funding is secured—whether through investors, loans, or revenue—the business enters the post-injection scaling phase. Cash is more available, but discipline remains critical. This is the time to build foundational roles: engineering leads, sales managers, customer success teams. Hiring should align with growth targets, not just ambition. A common mistake is over-hiring too quickly, assuming that more people equal faster growth. In reality, uncontrolled expansion can dilute culture, increase coordination costs, and strain systems. The financial strategy here is targeted investment—allocating budget to roles that directly accelerate revenue or reduce churn, while maintaining a lean support structure.

Finally, in the maturity optimization phase, the business has stable revenue and established operations. The focus shifts from growth at all costs to efficiency, retention, and innovation. Hiring becomes more specialized, with investments in leadership development, R&D, and process improvement. The financial goal is to maximize return on human capital—ensuring that every role contributes to profitability and long-term competitiveness. Companies at this stage often conduct regular talent audits, measuring performance, engagement, and ROI to refine their workforce strategy. By aligning each phase with financial reality, leaders avoid the pitfalls of premature scaling and build organizations that grow sustainably.

Tools That Bridge Finance and People Decisions

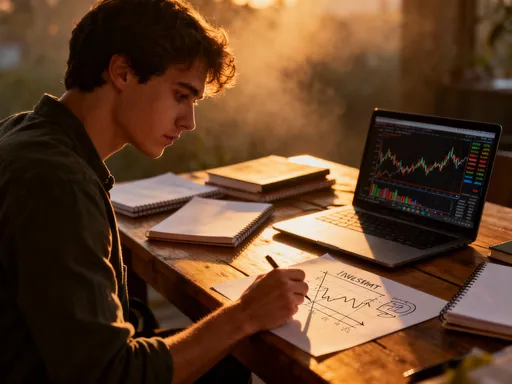

Translating financial principles into hiring decisions requires practical tools. While intuition plays a role, data-driven methods bring clarity and accountability. One such tool is talent ROI projection—the practice of estimating the financial return of a hire before making the offer. For example, a sales role might be evaluated based on the expected annual revenue it can generate minus salary and overhead. If a salesperson costs $120,000 annually but is projected to bring in $500,000 in new business, the ROI is clear. This approach shifts the conversation from “Can we afford this hire?” to “How much value will this hire create?”

Another powerful method is cost-of-delay analysis. This evaluates the financial impact of not making a hire on time. For instance, if delaying a customer support hire leads to a 10% increase in churn, and that churn costs $50,000 in lost revenue annually, the business can weigh that loss against the salary of the new hire. If the hire costs $60,000 but prevents $50,000 in losses, the decision becomes more nuanced—but at least it’s informed. This tool helps leaders avoid the trap of thinking that not hiring saves money, when in fact it may cost more in missed opportunities.

Headcount stress-testing is another valuable exercise. It involves modeling different hiring scenarios under various financial conditions—such as flat revenue, slower growth, or unexpected expenses—to see how the team holds up. For example, a company might ask: “If our burn rate increases by 20%, which hires can we sustain? Which roles are most critical?” This forces prioritization and reveals vulnerabilities in the current structure. It also prepares leaders for uncertainty, ensuring that talent decisions are not made in isolation from financial risk.

These tools don’t replace judgment—they enhance it. They bring financial rigor to people decisions without sacrificing agility. When used consistently, they help leaders move from reactive hiring to strategic workforce planning. Over time, this builds a culture where every talent investment is evaluated with the same seriousness as a capital expenditure, ensuring that people strategy aligns with financial health.

Building a Sustainable Engine: When People Strategy Fuels Financial Returns

The ultimate goal of aligning finance and hiring is to build a self-reinforcing engine of growth. When talent decisions are made with financial discipline, the result is not just cost control—it’s compounding returns. Great hires improve product quality, accelerate sales cycles, enhance customer satisfaction, and drive innovation. These outcomes feed back into revenue, profitability, and valuation, creating a virtuous cycle. Over time, the organization becomes stronger, more resilient, and more capable of seizing new opportunities.

This approach also transforms company culture. When employees see that hiring is strategic and performance is valued, they feel more confident in leadership and more invested in outcomes. Turnover decreases, engagement increases, and the business attracts higher-caliber talent. The financial benefits compound: lower recruitment costs, faster onboarding, and deeper institutional knowledge. In this environment, people are not just workers—they are partners in value creation.

Ultimately, the best investment a company can make is in its people—but only when that investment is made wisely. Treating talent as a core financial asset requires a shift in mindset, discipline in execution, and tools to measure impact. It means asking hard questions: Is this hire aligned with our financial stage? Does this role generate more value than it costs? Are we building a team that can adapt and grow with the business? Answering these questions honestly leads to better decisions, stronger teams, and sustainable success.

The most enduring companies are not those with the flashiest ideas or the most funding—they are the ones that manage their human capital with the same rigor as their financial capital. When you align smart money moves with smart hiring, you don’t just fill roles. You build a foundation for long-term prosperity. And that, more than any single hire, is the true driver of lasting financial return.