How I Sleep Better at Night Using This Bond Strategy

What if your portfolio could stay steady when markets go wild? I used to lose sleep watching my investments swing with the news—until I discovered smarter bond allocation. It’s not about chasing high returns; it’s about building stability. This method won’t make you rich overnight, but it helps protect what you’ve earned. Let me walk you through how I restructured my bonds to feel more secure, even when stocks tank. The journey wasn’t about finding a secret formula or chasing trends. It was about stepping back, reassessing my goals, and realizing that long-term financial health isn’t measured only by gains, but by resilience. That shift in mindset changed everything.

The Wake-Up Call: Why I Reevaluated My Portfolio

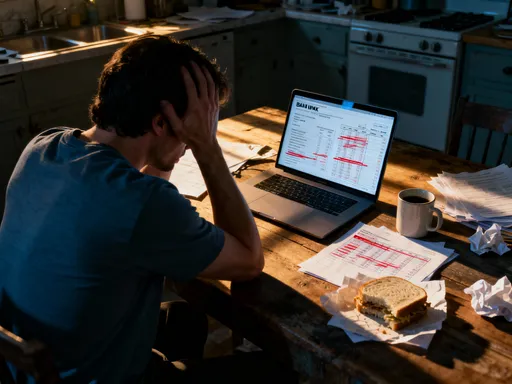

For over a decade, my investment strategy was simple: grow, grow, grow. I focused on stock funds, dividend payers, and a few tech ETFs that seemed to rise no matter what. My annual returns looked impressive on paper, and I felt proud of my progress. But then came the market correction of 2022. Within weeks, my portfolio dropped nearly 20%. That number wasn’t just a statistic—it felt personal. I remember sitting at my kitchen table, staring at my account balance, wondering how something that seemed so solid could erode so fast. I wasn’t alone. Many investors felt the same shock. But for me, that moment became a turning point.

What I realized wasn’t just that markets can fall—but that my portfolio lacked a reliable anchor. I had no structured defense. Everything moved in the same direction: up when times were good, down when fear took over. That’s when I began to question my assumptions. I had treated bonds as an afterthought, something you add only when you’re close to retirement. But I was only in my early 40s. Wasn’t it too soon? The more I read, the more I saw that financial stability isn’t about age—it’s about preparation. Whether you’re saving for your child’s education, planning for early retirement, or just trying to preserve what you’ve worked for, having a balanced approach matters.

So I started asking different questions. Instead of “What’s the next big winner?” I began asking, “What happens when things go wrong?” That shift in thinking led me to focus on risk management. I began studying how different asset classes behave during downturns. What I found was eye-opening: high-quality bonds, especially U.S. Treasuries and investment-grade corporates, often hold their value—or even increase—when stocks fall. They don’t eliminate losses, but they soften the blow. That doesn’t sound exciting, but for someone who values peace of mind, it was revolutionary. My goal wasn’t to beat the market anymore. It was to survive it, calmly and with confidence.

Bonds Aren’t Boring—They’re Your Portfolio’s Backbone

There’s a common myth that bonds are for retirees or the overly cautious. In the years leading up to 2022, many investors viewed bonds as dead weight—low returns, slow growth, and a drag on performance. Why hold something that barely keeps up with inflation when stocks are soaring? That thinking made sense—until the market shifted. When volatility returned, those same investors scrambled to find safety. Some sold at a loss. Others moved into cash, missing the rebound. But those with well-structured bond allocations didn’t need to panic. Their portfolios were designed to absorb shocks.

Think of bonds as the foundation of a house. You don’t see them once the walls go up, but they’re what keep everything standing when the wind blows. In financial terms, bonds provide diversification. When stock prices fall due to economic uncertainty, rising interest rates, or geopolitical tension, government bonds often act as a safe haven. Investors flock to them, pushing prices up and yields down. This inverse relationship with equities is not guaranteed, but it has held true across multiple market cycles. That doesn’t mean bonds always rise when stocks fall, but they tend to be less volatile, which helps stabilize the overall portfolio.

Another benefit is income. While stocks offer growth potential, bonds provide predictable interest payments—quarterly or semi-annually—regardless of market conditions. That income stream can be reinvested or used to cover living expenses, which is especially valuable for those nearing retirement. But even for younger investors, that steady return acts as a buffer. Over time, reinvested interest compounds quietly, adding to total returns without requiring market timing or speculation. More importantly, knowing that part of your portfolio is generating consistent income reduces anxiety. You’re not entirely dependent on price appreciation, which can vanish in a downturn.

And let’s be honest: peace of mind has real value. It’s hard to measure on a balance sheet, but it’s easy to feel. When I rebalanced my portfolio to include a meaningful bond allocation, my relationship with money changed. I stopped checking my account every day. I no longer reacted to headlines. I wasn’t chasing every new trend. Instead, I focused on long-term discipline. That emotional stability is just as important as financial stability. In fact, it’s often what keeps investors from making costly mistakes. Bonds may not make you rich quickly, but they help ensure you don’t lose what you already have.

The Problem With Most Bond Strategies

Despite their importance, many investors approach bonds the wrong way. They treat bond allocation like a one-time decision: open a bond fund, set a target percentage, and forget about it. Or worse, they lump all bonds together as if they’re the same. But not all bonds are created equal. There are critical differences in duration, credit quality, yield, and sensitivity to interest rates. Ignoring these factors can turn what’s supposed to be a stabilizing force into a source of unexpected risk.

One of my early mistakes was buying a long-term Treasury bond fund during a period of low interest rates. At the time, it offered a decent yield and seemed safe. But when the Federal Reserve began raising rates in 2022 to combat inflation, the value of that fund dropped sharply. Why? Because bond prices move inversely to interest rates. When rates go up, existing bonds with lower yields become less attractive, so their prices fall. Long-term bonds are especially sensitive to this effect, known as duration risk. A bond with a duration of 10 years could lose roughly 10% of its value for every 1% rise in interest rates. I didn’t fully understand that at the time, and I paid the price.

Another issue is credit risk. Not all bonds carry the same level of safety. U.S. Treasury bonds are backed by the full faith and credit of the government, making them one of the safest investments available. Municipal bonds, issued by state and local governments, also tend to be low-risk, especially if you live in the state issuing the bond and can benefit from tax-free income. Corporate bonds, on the other hand, vary widely. Investment-grade bonds from stable companies are relatively safe, but high-yield or “junk” bonds come with much higher default risk. I almost bought into a high-yield fund because the advertised returns looked attractive—until I read the fine print and realized the issuers were in shaky industries.

Diversification matters just as much in bonds as it does in stocks. Putting all your bond money into one type or sector increases vulnerability. For example, if you only hold corporate bonds and a recession hits, multiple companies could face financial stress at once, driving down bond prices. Similarly, focusing only on long-term bonds leaves you exposed to rate hikes. A smarter approach is to build a ladder—mixing short, intermediate, and long-term bonds—so that your portfolio isn’t overly dependent on any single interest rate environment. The key is intentionality. Bonds shouldn’t be an afterthought. They should be carefully selected, regularly reviewed, and aligned with your risk tolerance and time horizon.

My 4-Part Framework for Smarter Bond Allocation

After my early missteps, I knew I needed a better system. I didn’t want to overcomplicate things, but I also didn’t want to leave protection to chance. So I developed a four-part framework that’s both practical and sustainable. It’s not about beating the market or finding hidden opportunities. It’s about building a foundation that can withstand uncertainty. Here’s how it works.

First, I diversified across bond types. My allocation includes U.S. Treasury bonds for safety, municipal bonds for tax efficiency, and investment-grade corporate bonds for slightly higher yields. Each serves a purpose. Treasuries act as a safe haven during stress. Municipals provide tax-free income, which is especially valuable in higher tax brackets. Corporates add modest yield without taking on excessive risk. By spreading across these categories, I reduce exposure to any single source of risk. If one sector underperforms, others may hold steady or even gain.

Second, I built a maturity ladder. Instead of putting all my money into long-term bonds, I divided it across short (1–3 years), intermediate (4–7 years), and long-term (8–10 years) maturities. This approach smooths out interest rate risk. When rates rise, I’m not stuck with low-yielding long bonds. As shorter bonds mature, I can reinvest at higher prevailing rates. When rates fall, my longer bonds maintain higher yields, providing stability. This ladder structure also gives me flexibility. I know when bonds will mature, so I can plan for future cash needs without selling in a down market.

Third, I set a fixed target allocation based on my risk tolerance and goals. I’m in my 40s, so I’m not ultra-conservative, but I’m also not chasing maximum growth. After analyzing my situation, I decided that 30% of my portfolio would be in bonds, with the rest in equities and other assets. This percentage isn’t arbitrary—it’s based on my timeline, income needs, and comfort with volatility. I revisit this target annually. If market movements shift my allocation beyond a 5% band, I rebalance. This keeps my portfolio aligned with my strategy without reacting to short-term noise.

Fourth, I review my bond holdings once a year, not more. Constant tinkering leads to emotional decisions. Instead, I assess credit quality, interest rate trends, and my personal situation. I check whether any bonds are approaching maturity, if yields have changed significantly, or if my financial goals have shifted. This disciplined, rules-based approach removes emotion and keeps me focused on the long term. It’s not exciting, but it’s effective. Over time, this structure has given me confidence—knowing that my portfolio is designed to endure, not just perform.

How This Approach Protects Against Market Swings

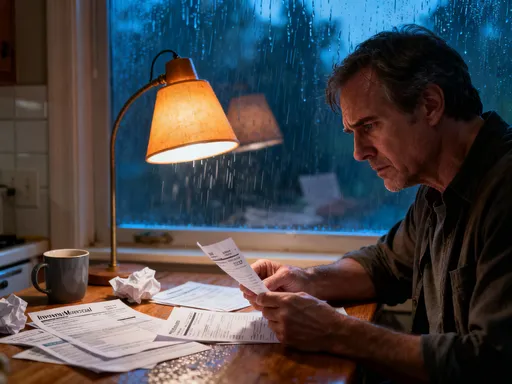

Last year, when stock markets declined due to inflation concerns and rate hikes, my portfolio didn’t escape unscathed. My equity holdings dropped, as expected. But something important happened: my bond allocation held firm. While long-term Treasuries did decline slightly due to rising rates, the short and intermediate bonds in my ladder minimized the impact. Municipal and corporate bonds, especially those with shorter durations, remained stable. The overall effect was a much smaller drawdown than I would have experienced with a stock-heavy or poorly structured bond portfolio.

More importantly, I didn’t panic. While others were selling stocks at depressed prices, I stayed calm. My bond income continued to flow, and my portfolio’s balance gave me the psychological space to think clearly. In fact, I used the downturn as an opportunity. Because I had a rebalancing rule, I sold some of my bonds that had held value and bought more stocks at lower prices. This isn’t market timing—it’s disciplined portfolio management. By buying low and selling high within my existing asset allocation, I improved my long-term return potential without taking on unnecessary risk.

That’s the real power of a well-structured bond strategy: it protects not just your money, but your decision-making. Financial stress often leads to poor choices—selling low, chasing returns, abandoning plans. But when you know part of your portfolio is designed to be stable, you’re less likely to react emotionally. You can stick to your plan, even when the news is scary. That consistency is what leads to long-term success. Markets will always have ups and downs. The goal isn’t to avoid them, but to navigate them without losing your way. A thoughtful bond allocation makes that possible.

Common Mistakes (And How I Avoided Them)

Looking back, I almost made several classic errors. The first was the temptation to chase yield. When I saw bond funds advertising returns of 5% or more, I was intrigued. But I took the time to dig deeper. Many of those high yields came from lower-rated bonds, emerging market debt, or complex structured products. The risk wasn’t worth the reward. I reminded myself that my goal wasn’t to maximize income—it was to preserve capital and reduce volatility. I stuck with investment-grade bonds and avoided anything I didn’t fully understand.

Another trap was market timing. I caught myself thinking, “Interest rates are high now—should I wait to buy bonds?” Or, “Rates might fall—should I lock in long-term bonds today?” These questions sound smart, but they’re based on predictions, not strategy. No one knows where rates will go next. Instead of guessing, I followed my plan. I invested gradually, using a dollar-cost averaging approach for new bond purchases. This reduced the risk of buying at the wrong time and kept me consistent.

I also avoided emotional trading. It’s easy to sell bonds when rates rise and prices fall, especially if you see red numbers on your screen. But I reminded myself that bonds are long-term holdings. Unless there’s a credit downgrade or a change in my goals, I don’t sell based on price fluctuations. I focus on the income and stability they provide. I also resisted the urge to replace bonds with alternatives like dividend stocks or real estate investment trusts (REITs). While those can be part of a portfolio, they don’t offer the same low correlation with stocks. When markets fall, they often fall together. True diversification means holding assets that behave differently under stress—and high-quality bonds still do that better than most.

Finally, I embraced simplicity. I didn’t need exotic products, leveraged ETFs, or complex derivatives. A portfolio of low-cost, diversified bond funds—held with discipline—does the job. I use index-based bond funds and ETFs to keep fees low and exposure broad. I don’t try to outsmart the market. I let time, compounding, and structure do the work. That simplicity has been my greatest advantage.

Why This Matters More Now Than Ever

Today’s financial environment is full of uncertainty. Inflation has disrupted decades of stability. Interest rates are higher than they’ve been in years, but no one knows how long that will last. Geopolitical tensions, shifting labor markets, and evolving monetary policy add to the unpredictability. In times like these, having a stable core in your portfolio isn’t just wise—it’s essential. You don’t need to predict the future to prepare for it. A well-structured bond allocation acts as a financial shock absorber, helping you stay on track no matter what happens.

I’m not suggesting that bonds will deliver huge returns. They won’t. But they serve a critical role: they help you avoid catastrophic losses. And in investing, avoiding big losses is often more important than chasing big gains. A 20% loss requires a 25% gain just to break even. A 50% loss requires a 100% gain. That’s why preservation matters. For anyone saving for retirement, funding education, or building a legacy, minimizing downside risk is a form of progress.

More than that, this approach supports long-term discipline. When your portfolio is designed to handle stress, you’re less likely to abandon your plan at the worst possible time. You can stay invested, keep contributing, and benefit from market recoveries. That consistency—over years and decades—is what builds wealth. It’s not flashy. It doesn’t make headlines. But it works.

In the end, my bond strategy isn’t about getting rich. It’s about sleeping better at night. It’s about looking at my account statement without anxiety. It’s about knowing that no matter what the market does tomorrow, I’m prepared. That sense of control and calm is worth more than any short-term return. And for anyone who values security, stability, and long-term peace of mind, it’s a strategy worth considering.