How I Cracked Early Retirement by Riding Market Waves—Not Fighting Them

What if you could retire years earlier—not by earning more, but by aligning your money with the real rhythm of the market? I spent years chasing quick wins, only to hit walls. Then I shifted focus: instead of predicting trends, I learned to read them, adapt, and protect what mattered most. This is the strategy that changed everything—no hype, just real moves that worked when it counted. It wasn’t about outsmarting Wall Street or landing a six-figure bonus. It was about understanding that markets move in waves, and those who learn to ride them—rather than resist them—can unlock financial freedom years ahead of schedule. The journey wasn’t glamorous, but it was grounded in patience, observation, and disciplined action.

The Wake-Up Call: Why Traditional Saving Wasn’t Enough

For years, I believed early retirement was a math problem: earn more, spend less, save aggressively. I followed the playbook to the letter. I brought my lunch to work, skipped weekend outings, and maxed out my 401(k) contributions every year. I felt virtuous—until I realized I wasn’t actually getting closer to freedom. Despite saving diligently, inflation quietly eroded my purchasing power. A dollar today wouldn’t buy what it did a decade ago, and my nest egg, though growing on paper, wasn’t truly keeping pace with the rising cost of living. The truth hit hard: saving alone is not a growth strategy. It’s a defense mechanism, and while essential, it’s insufficient for meaningful financial independence.

What I failed to grasp early on was that real wealth isn’t built solely through accumulation—it’s built through appreciation. My money was parked in low-yield accounts and static investments, waiting for time to do the work. But time alone doesn’t create wealth; smart allocation does. I began studying historical market cycles and realized that periods of strong economic expansion were often driven not by income increases, but by capital gains—assets increasing in value because they were positioned correctly. That’s when I understood the flaw in my approach. I wasn’t missing discipline; I was missing direction. I needed to shift from passive saving to active positioning—aligning my portfolio with the forces already shaping the economy, rather than hoping they’d eventually lift me by default.

This realization changed everything. I stopped seeing retirement as a distant finish line and started viewing it as a dynamic process. Instead of asking, “How much can I save this year?” I began asking, “Where is value being created right now?” That subtle shift in perspective opened the door to a more effective strategy. I didn’t need to earn twice as much or live on rice and beans. I needed to understand the flow of capital and position myself where growth was already happening. The goal wasn’t to outwork the system, but to work with it—leveraging market momentum instead of fighting against it.

Spotting Trends Before They Go Mainstream

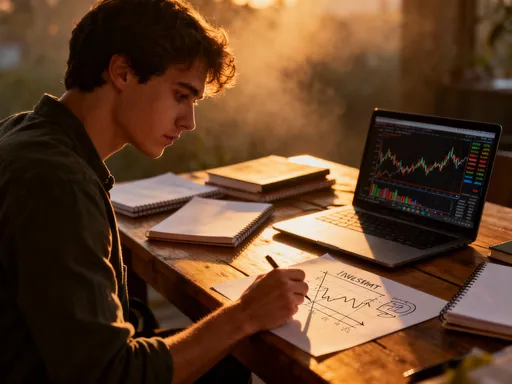

One of the most powerful lessons I learned was that significant financial gains often come not from reacting to trends, but from anticipating them. Big moves in the market rarely happen overnight—they start with small shifts in behavior, technology adoption, or consumer preferences. The key is learning to see these signals before they become obvious to everyone. For example, years before remote work became the norm, I noticed a quiet but growing shift. More friends were working from home occasionally. Tech companies were investing heavily in collaboration tools. Real estate patterns in urban centers began to show subtle signs of strain. These weren’t headlines yet, but they were real indicators of change.

I didn’t rush to sell everything and buy Zoom stock. Instead, I began adjusting my thinking. I looked at sectors that would benefit from a decentralized workforce—cloud computing, cybersecurity, digital payment platforms, even residential broadband infrastructure. I increased my exposure to these areas gradually, using low-cost index funds and ETFs that provided broad exposure without overconcentration. The idea wasn’t to time the market perfectly, but to position early enough to benefit when the trend gained momentum. By the time remote work became a household topic, my portfolio was already aligned with the shift, and the gains followed naturally.

Learning to spot these leading indicators required patience and observation. I started paying attention to data points that others overlooked—shipment volumes for certain tech components, patent filings in emerging industries, even changes in job market demand. These signals don’t scream for attention, but they whisper. For instance, when electric vehicle adoption began accelerating, it wasn’t the car sales numbers that caught my eye first—it was the surge in lithium mining investments and charging infrastructure projects. That told me the ecosystem was expanding, not just the end product. Acting on these insights early allowed me to participate in growth phases without chasing prices at their peak.

Building a Portfolio That Adapts, Not Reacts

Many investors build portfolios like monuments—rigid, static, and designed to last forever. But markets are not monuments; they are rivers, constantly shifting course. A portfolio that can’t adapt will eventually crack under pressure. I learned this the hard way during a period of unexpected volatility. My initial strategy was heavily weighted toward long-term holdings with little room for adjustment. When sector dynamics changed rapidly, I was stuck—either selling at a loss or waiting indefinitely for recovery. That experience taught me the value of flexibility.

I rebuilt my portfolio around the principle of adaptive positioning. I kept a strong foundation in broad market index funds—low-cost, diversified, and reliable over time. But on top of that base, I added tactical allocations that could be adjusted as conditions evolved. Think of it like a house: the foundation is permanent, but the interior layout can be remodeled. If healthcare innovation accelerates, I can increase exposure to medical technology ETFs. If energy efficiency becomes a larger priority, I can shift toward renewable infrastructure funds. The key is having a system that allows for movement without sacrificing core stability.

This approach doesn’t require constant trading or market timing. It’s about having a process for regular review and adjustment. I set quarterly check-ins to assess macroeconomic trends, sector performance, and global developments. If a trend I anticipated is gaining strength, I may increase my position incrementally. If a sector shows signs of overheating, I reduce exposure before a correction hits. This isn’t speculation—it’s course correction based on evidence. The result is a portfolio that moves with the economy, not against it, reducing emotional decision-making and increasing long-term consistency.

Risk Control: My Safety Net in Volatile Times

Growth without protection is like driving fast without a seatbelt. I’ve seen too many people build impressive portfolios only to lose them during downturns because they ignored risk management. My strategy places equal emphasis on preserving capital and growing it. One of the most important tools I use is continuous stress testing. I regularly ask myself, “What if interest rates spike?” “What if a major sector collapses?” “What if inflation accelerates unexpectedly?” These aren’t fear-based questions—they’re planning exercises. By imagining worst-case scenarios, I can design a portfolio that withstands them.

Diversification is central to this effort, but I’ve moved beyond the basic idea of splitting money between stocks and bonds. True diversification means spreading risk across geographies, asset classes, and income sources. I hold investments in developed and emerging markets, allocate across growth and value stocks, and include real assets like real estate and commodities. I also maintain multiple layers of liquidity—cash reserves, short-term bonds, and accessible credit lines—so I’m never forced to sell investments at a loss during a crisis. This layered approach ensures that no single event can derail my financial plan.

Another critical component is having clear exit signals, not emotional triggers. Instead of reacting to market noise, I set predefined rules for when to reduce exposure. For example, if a sector’s valuation reaches a historically high level relative to its earnings, I begin scaling back. If macroeconomic data shows a sustained slowdown, I increase defensive holdings. These decisions are based on data, not emotion. This discipline has allowed me to avoid major drawdowns and stay invested through recoveries. Risk control isn’t about avoiding all losses—it’s about ensuring that losses don’t threaten long-term goals.

Income That Works While You Don’t

Early retirement doesn’t mean income stops—it means income becomes decoupled from time. One of my primary goals was to build streams of passive income that could sustain my lifestyle without requiring daily effort. I focused on assets that generate returns through ownership, not labor. Dividend-paying stocks in resilient industries became a cornerstone. Companies with a history of increasing payouts year after year—firms in healthcare, consumer staples, and utilities—provided steady cash flow even during market fluctuations. These aren’t speculative holdings; they’re businesses with durable demand, and their dividends compound over time.

Real estate also played a key role. I didn’t buy luxury properties or flip houses. Instead, I invested in modest rental units in areas with strong tenant demand—near universities, growing suburbs, or transportation hubs. These properties were purchased with conservative financing and generate reliable monthly income. Over time, appreciation and mortgage paydown increased equity, further strengthening my financial position. The income from these rentals isn’t extravagant, but it’s consistent, and it covers a significant portion of my living expenses.

I also explored alternative income sources, such as small stakes in private ventures aligned with long-term trends. These aren’t high-risk bets—they’re carefully vetted opportunities in areas like sustainable agriculture, education technology, and local infrastructure. The returns aren’t immediate, but they compound quietly over time. The beauty of these income streams is that they work whether I’m actively managing them or not. They provide financial breathing room, reduce reliance on market timing, and allow me to maintain flexibility in retirement.

The Mindset Shift: From Chasing Returns to Preserving Freedom

The most transformative change in my journey wasn’t financial—it was psychological. For years, I measured success by portfolio size, quarterly returns, and how close I was to a six-figure net worth. But that mindset kept me anxious, always chasing the next big win. The shift came when I stopped focusing on returns and started focusing on freedom. I began asking different questions: Can I afford to say no to a job I dislike? Can I handle a medical emergency without touching my investments? Can I travel, help family, or pursue hobbies without financial stress?

This reframe changed my behavior. I became less interested in high-risk, high-reward plays and more committed to stability and optionality. I stopped checking my portfolio daily. I ignored market noise and social media hype. Instead, I focused on building a life where money served me, not the other way around. This mental shift reduced stress, improved decision-making, and actually led to better long-term outcomes. When you’re not desperate for returns, you’re less likely to make impulsive mistakes. You can wait for the right opportunities, stick to your strategy, and let compounding do its work.

Freedom, I realized, isn’t just about having enough money—it’s about having control. It’s knowing you have choices. That mindset made me more disciplined, not less. I saved consistently, invested thoughtfully, and avoided lifestyle inflation. The goal wasn’t to get rich quickly, but to stay free, steady, and in control—no matter what the economy did. And that, more than any single investment, became the foundation of my early retirement.

Putting It All Together: My Real-World Framework

All of these pieces—trend awareness, adaptive positioning, risk control, and passive income—come together in a repeatable, practical framework. I don’t rely on complex algorithms or insider information. My process is built on observation, adjustment, and patience. Every quarter, I review macroeconomic data, sector trends, and personal financial goals. I assess whether my portfolio is still aligned with the real economy. If a trend I identified is maturing, I may reduce exposure. If a new opportunity emerges, I allocate modestly and monitor closely.

I maintain a core portfolio of low-cost index funds that track broad markets—this is my anchor. Around that core, I use tactical ETFs and individual holdings to capture specific trends. I rebalance annually to maintain target allocations and ensure I’m not overexposed to any single area. I also keep a close eye on expenses, tax efficiency, and estate planning, ensuring that every part of my financial life supports the whole.

This system isn’t about beating the market. It’s about staying in it—consistently, wisely, and with minimal emotional interference. I’ve accepted that I won’t catch every upswing or avoid every downturn. But by riding the broader waves of economic change, I’ve achieved steady growth and reduced volatility. The result? I reached financial independence years earlier than expected, not through luck, but through alignment. I stopped fighting the market and started flowing with it.

Early retirement isn’t about luck or timing the market perfectly. It’s about building a strategy that moves with the economy, not against it. I learned to stop forcing outcomes and start flowing with trends—protecting capital, capturing growth, and preserving freedom. The goal isn’t to get rich fast. It’s to stay free, steady, and in control—no matter what the market throws next.