How I Navigate Financial Shocks—A Professional’s Take on Trend-Smart Moves

Financial accidents don’t come with warnings. A sudden market dip, an unexpected job loss, or a personal crisis can shake your stability in seconds. I’ve been there—watching my portfolio dip hard and feeling the panic set in. But over time, I’ve learned to read the signals before the storm hits. It’s not about reacting faster; it’s about seeing the trend earlier and acting with clarity. This is how I protect and position myself—professionally, calmly, and strategically. The difference between surviving and thriving during financial shocks isn’t luck. It’s awareness, preparation, and a mindset trained to see what others overlook. In this article, I’ll walk through the real moments of pressure, the tools that help me stay ahead, and the disciplined habits that turn volatility into opportunity—not fear.

The Moment Everything Shifted: Facing a Real Financial Shock

It started with a headline—brief, unassuming, and easy to miss. A major tech company reported weaker-than-expected earnings. At first, it seemed like routine market noise. But within days, more sectors began to wobble. Consumer confidence dipped. Bond yields climbed. Then came the job cut announcements—first in tech, then in finance, then retail. I remember sitting at my desk, watching my diversified portfolio lose 15% in three weeks. What made it worse wasn’t the loss itself, but the feeling of helplessness. I had followed the standard advice: save six months of expenses, invest in low-cost index funds, and stay the course. Yet none of that seemed to matter when the ground shifted beneath me.

That experience changed my understanding of financial security. I realized that traditional safety nets—while important—are often reactive, not preventive. They assume stability and gradual change, but real financial shocks arrive abruptly and compound quickly. A job loss doesn’t wait for your emergency fund to grow. A market crash doesn’t pause so you can rebalance. Many people believe they’re protected because they have a retirement account or home equity, but these assets aren’t always liquid or stable when you need them most. The truth is, financial resilience isn’t built on static plans. It’s built on the ability to detect change early and adapt quickly. That moment of crisis forced me to ask a new question: not “Am I prepared?” but “Am I aware?”

What I discovered was that financial preparedness isn’t just about how much you save, but how well you observe. The people who navigated that downturn with the least damage weren’t necessarily the wealthiest or most connected. They were the ones who noticed the warning signs sooner—the slowing spending habits, the shift in market sentiment, the tightening of credit. They didn’t wait for a crisis to act. They adjusted their positions incrementally, reducing exposure, increasing liquidity, and protecting their core assets before the storm hit full force. This wasn’t speculation or fear-driven selling. It was trend-based decision-making—a skill that can be learned, practiced, and refined over time.

Seeing the Signs: How Professionals Spot Financial Trouble Early

Professionals don’t predict the future. What they do is interpret signals. The financial world is full of noise—headlines, rumors, short-term swings—but beneath that surface, real trends form. These trends don’t emerge overnight. They start as subtle shifts: a change in inflation expectations, a slowdown in housing permits, a widening of credit spreads. Most individuals overlook these indicators because they don’t seem urgent. But for those trained to see them, they are like weather patterns before a storm. The key isn’t reacting to every fluctuation, but recognizing which signals are meaningful and which are distractions.

One of the most reliable early warnings is consumer behavior. When people start cutting back on discretionary spending—delaying vacations, postponing car purchases, or reducing dining out—it often signals broader economic stress. Retail sales data, credit card spending reports, and even restaurant reservation trends can offer insight. Another critical signal is in the bond market. When investors demand higher yields for holding longer-term debt, it reflects growing concern about inflation or economic instability. This is known as a flattening or inverting yield curve, a pattern that has preceded most recessions in recent decades. While not perfect, it’s a data point professionals take seriously.

Corporate earnings also provide valuable clues. A single weak report may not mean much, but when multiple companies across different sectors begin to cite rising costs, slowing demand, or supply chain issues, it suggests a systemic shift. Earnings season becomes more than a market event—it’s a diagnostic tool. Similarly, labor market data, such as initial jobless claims or job openings, can reveal whether the economy is cooling. A sudden rise in layoffs, even in one industry, can ripple outward if not addressed. These indicators don’t predict exact timing, but they increase the probability of a downturn, giving you time to adjust.

The difference between amateurs and professionals is not access to information—it’s interpretation. Most of these data points are public and free. What professionals add is context. They ask: Is this a one-time blip or part of a pattern? Is the trend accelerating or stabilizing? They avoid emotional reactions and focus on consistency across multiple sources. For example, if inflation is rising, unemployment is falling, and consumer spending is strong, the economy may be overheating—not collapsing. But if inflation is high, spending is weak, and job growth is slowing, that’s a different picture. Seeing the signs isn’t about fear. It’s about clarity. And clarity leads to better decisions.

Building Your Financial Radar: Tools That Help You Stay Ahead

You don’t need a Bloomberg Terminal to stay informed. There are practical, accessible tools that anyone can use to build a personal financial radar. The goal isn’t to become a data analyst, but to develop a routine that keeps you aware of key trends without overwhelming your time. Start with an economic calendar. Many financial websites offer free versions that list upcoming events—Federal Reserve meetings, inflation reports, employment data, and GDP releases. Mark these dates and spend 10 to 15 minutes reviewing the results. You don’t need to understand every detail. Just ask: Is the number higher or lower than expected? What does it suggest about the economy’s direction?

Next, track your personal cash flow with a simple dashboard. This doesn’t require advanced software. A spreadsheet or a budgeting app can show your income, expenses, savings rate, and debt payments over time. Watch for changes—like rising utility bills, increased credit card balances, or slower progress on savings. These micro-trends reflect macro-challenges. If your household is feeling the squeeze, others likely are too. This personal data, combined with broader economic indicators, gives you a more complete picture. It turns abstract numbers into real-life impact.

News aggregation tools can also help. Instead of scrolling through endless headlines, use platforms that curate financial news by relevance and credibility. Look for sources that provide analysis, not just reporting. For example, a summary of how inflation affects different asset classes is more useful than a sensational headline about market swings. Podcasts and newsletters from reputable financial institutions can offer weekly insights without requiring hours of reading. The key is consistency—checking in regularly, not constantly.

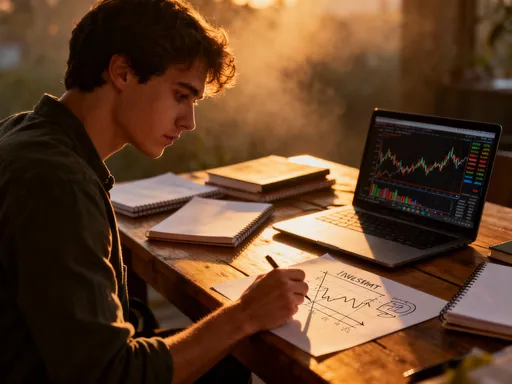

Finally, use visual tools like charts and trend lines. A simple line graph of the S&P 500 over the past year can show you whether the market is in a steady climb, a correction, or a potential bear market. Overlay it with interest rate trends or unemployment data, and patterns emerge. These visuals help you see relationships between variables. For instance, when interest rates rise and stock valuations fall, it often reflects tighter monetary policy. You don’t need to act on every movement, but you can prepare for possible outcomes. Building your financial radar isn’t about complexity. It’s about creating a habit of observation—small, regular inputs that keep you informed and in control.

Risk Control Is Not Passive: Active Shields in Turbulent Times

Many people think risk control means diversification—spreading money across stocks, bonds, and real estate. While diversification helps, it’s not enough during severe downturns. When panic spreads, correlations rise. Assets that normally move independently may all fall together. That’s why professionals treat risk control as an active process, not a one-time setup. It means adjusting your exposure based on conditions, not just hoping for the best. This isn’t market timing. It’s risk management—making incremental changes to protect capital when the odds shift.

One common strategy is asset allocation rebalancing. If stocks have performed well and now make up a larger portion of your portfolio than planned, you sell some and reinvest in bonds or cash. This locks in gains and reduces exposure to potential losses. It’s a disciplined way to “sell high” without emotion. Another technique is using defensive sectors. During uncertain times, industries like utilities, healthcare, and consumer staples tend to be more stable because people still need electricity, medicine, and groceries. Shifting a portion of your equity exposure to these areas can reduce volatility without leaving the market.

Cash is another powerful tool. Holding a higher-than-normal cash position during periods of high uncertainty gives you flexibility. It acts as a buffer, allowing you to meet expenses without selling assets at a loss. It also positions you to act when opportunities arise. Some investors fear holding cash because of inflation or missed gains, but its value isn’t in returns—it’s in optionality. It gives you the power to choose when and how to invest, rather than being forced to sell under pressure.

More advanced investors may use hedging strategies, such as options or inverse ETFs, to reduce downside risk. These tools are complex and not for everyone, but the principle applies broadly: prepare for multiple outcomes. For example, if inflation remains high, Treasury Inflation-Protected Securities (TIPS) can help preserve purchasing power. If interest rates are expected to fall, longer-duration bonds may perform better. The point is not to predict, but to prepare. Active risk control means asking: What are the biggest threats to my financial plan right now? And what small adjustments can I make to reduce that risk? It’s not about perfection. It’s about progress.

Turning Risk into Opportunity: When Accidents Create Openings

Financial shocks are not just threats—they can be opportunities in disguise. When markets fall, asset prices drop. For those with cash and clarity, this is when long-term wealth can be built. But opportunity only favors the prepared. Panic selling creates undervalued assets. Disciplined buying creates long-term gains. The key is not to react emotionally, but to follow a plan. Professionals don’t see downturns as disasters. They see them as moments when the market rewards patience and preparation.

One effective approach is dollar-cost averaging during declines. Instead of trying to pick the bottom, you invest a fixed amount at regular intervals. This means you buy more shares when prices are low and fewer when they’re high, lowering your average cost over time. It removes the pressure to time the market and turns volatility into an advantage. For example, during the 2020 market drop, investors who continued contributing to their retirement accounts bought stocks at significant discounts. Within 12 to 18 months, many of those investments had not only recovered but reached new highs.

Another strategy is sector rotation. When one part of the economy struggles, another often grows. For instance, during periods of high inflation, energy and materials companies may outperform. In times of economic recovery, consumer discretionary and technology sectors often lead. By monitoring trends, you can shift your focus to areas with stronger fundamentals. This doesn’t mean chasing hot stocks. It means aligning your portfolio with the economic reality, not the headlines.

Psychological resilience is just as important as financial strategy. The hardest part of investing during a crisis isn’t the analysis—it’s the emotions. Fear, doubt, and impatience can lead to poor decisions. That’s why having a written investment plan is critical. It serves as a guide when feelings run high. It reminds you of your goals, time horizon, and risk tolerance. When the market drops, you don’t ask, “Should I sell?” You ask, “Does this change my long-term outlook?” If the answer is no, then inaction can be the right action. Staying the course, when it’s based on sound principles, is a form of courage.

The Discipline Behind the Moves: Habits That Keep You Steady

Success in financial management isn’t about big, dramatic decisions. It’s about small, consistent habits. The most effective investors aren’t the ones who make bold calls. They’re the ones who show up regularly, review their data, and make adjustments without drama. Discipline turns insight into action. It keeps you from drifting off course when emotions run high or distractions pile up. The best financial radar in the world is useless if you don’t use it.

Start with a monthly review. Set a recurring date to assess your portfolio, cash flow, and key economic indicators. Check your asset allocation. Are you still within your target ranges? Review your emergency fund. Is it still sufficient for your needs? Look at inflation and interest rate trends. Are they affecting your spending or investment strategy? This doesn’t need to take more than an hour. The goal is awareness, not overhaul. Over time, these reviews build a mental map of your financial landscape, making it easier to spot changes.

Daily habits matter too. Spend 10 minutes reading a trusted financial summary. Track your spending if you use a budgeting app. Note any major economic news, but avoid the noise. The discipline isn’t in doing everything at once, but in doing something every day. These small inputs compound, just like investments. They keep you connected to your financial reality, not just your hopes or fears.

Another powerful habit is stress-testing your plan. Ask: What if my income drops by 20%? What if healthcare costs rise? What if the market falls 30%? Run simple scenarios to see how your finances would hold up. You don’t need complex models. Just basic math. This exercise isn’t meant to scare you. It’s meant to prepare you. It highlights vulnerabilities so you can address them before they become crises. For example, if you find that a job loss would deplete your savings in three months, you know to focus on building a larger buffer or increasing income streams.

Finally, practice decision-making in calm times. Make small portfolio adjustments when the market is stable. Test your tools. Refine your process. That way, when pressure comes, you’re not learning on the fly. You’re executing a plan you’ve already practiced. Discipline isn’t about rigidity. It’s about readiness. And readiness breeds confidence.

Preparing for the Next Shock: A Smarter, Trend-Aware Financial Future

Financial resilience isn’t about avoiding shocks. It’s about navigating them with clarity and control. The next crisis isn’t a question of if, but when. It could be a market correction, a personal setback, or a global event. But preparation changes the outcome. Those who see the signs early, use the right tools, and act with discipline don’t just survive—they adapt and grow. The goal isn’t to eliminate risk. It’s to manage it wisely, with a mindset focused on foresight, not fear.

What separates the overwhelmed from the in-control is not intelligence or wealth. It’s awareness. It’s the habit of paying attention, of asking questions, of adjusting before the storm hits. You don’t need to be a financial expert to benefit from trend judgment. You just need to be consistent, curious, and willing to act. The tools are available. The data is public. The strategies are proven. What matters most is the decision to engage—to stop reacting and start observing.

As you move forward, remember that financial security is not a destination. It’s a practice. It’s built through small, smart choices made over time. It’s strengthened by habits that keep you grounded and informed. And it’s powered by the confidence that comes from preparation. The next shock will come. But if you’re watching the trends, managing your risks, and staying disciplined, you won’t just endure it. You’ll emerge stronger. That’s not luck. That’s strategy. And it’s within your reach.